The financial technology sector has changed people’s habits regarding money management, payment, investing, and accessing different financial service sectors. Such innovation, however, is accompanied by a huge responsibility: guaranteeing every single transaction’s safety and also keeping up with the stringent regulatory requirements. Fintech apps are expected to provide security and be compliant with the regulations. As the number of cyber threats increases, the threats become more sophisticated, and the compliance laws vary from country to country.

Topmost fintech platforms usually work together with a mobile app development agency in the USA to design the systems that are to be built, prioritizing data protection, fraud prevention, and compliance from the very beginning. Here are seven ways fintech apps secure transactions while maintaining compliance with regulatory standards.

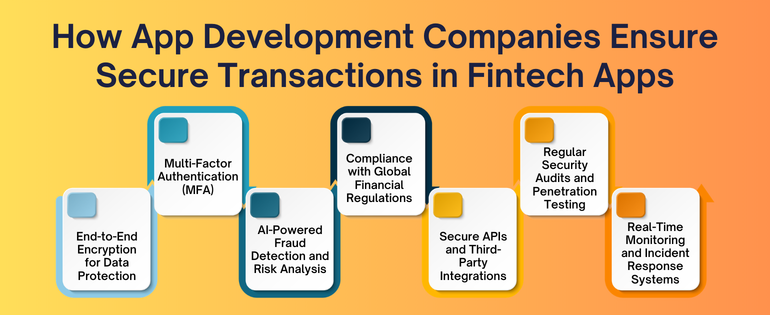

How App Development Companies Ensure Secure Transactions in Fintech Apps?

1. End-to-End Encryption for Data Protection

End-to-end encryption is one of the main foundations of fintech security. The process of encryption encompasses the whole transaction, starting from the login credentials and ending with the payment data, and it is done during both transmission and storage. Because of this, even if the data is intercepted, it will be unreadable to unauthorized entities.

To create secure APIs and encrypted databases, fintech companies frequently depend on backend systems developed by a trusted php development company. PHP is still a preferred option for financial platforms because of its adaptability and its capability to blend in powerful encryption libraries. Fintech apps are able to greatly minimize the chance of breaches by safeguarding their data, both at rest and in transit.

2. Multi-Factor Authentication (MFA) to Prevent Unauthorized Access

Only passwords are not enough anymore. Financial technology applications employ multi-factor authentication (MFA), which is a combination of the user’s knowledge (password), the user’s possession (one-time password or device), and, on some occasions, the user’s identity (biometrics).

The use of biometrics like fingerprint and facial recognition has become an integral part of mobile banking and payment apps. Most of the USA mobile app development agency teams include MFA in the design phase so that the user experience is smooth and security is not compromised.

3. AI-Powered Fraud Detection and Risk Analysis

The rise of artificial intelligence has revolutionized the security aspect of the fintech industry. Real-time analysis of transaction behavior is done through the use of machine learning models in modern fintech platforms. These systems are capable of identifying and promptly flagging or blocking transactions based on detected anomalies like strange spending habits or unauthorized login attempts.

That is the reason why ai development companies are considered to be of great importance. They support the development of intelligent fraud detection systems that allow fintech apps to prevent fraud proactively instead of just reacting to it after the losses have been incurred. Also, the experienced ai development services make it possible to have a predictive risk scoring system that minimizes the number of false positives while still being compliant with the regulations.

4. Compliance with Global Financial Regulations

In the realm of fintech, regulatory compliance is considered to be of utmost importance. Applications are expected to conform to the different guidelines as per the region, for instance, the PCI-DSS, GDPR, SOC 2, KYC (Know Your Customer), and the laws concerning Anti-Money Laundering (AML).

It has become commonplace for fintech applications to outsource to a php development company with a good reputation to create architectures that are ready for compliance. Compliance is implemented in the backend architecture, starting from secure payment gateways to proper audit logs. Partnering with a mobile app development company USA also guarantees compliance with US financial regulations and data privacy laws.

5. Secure APIs and Third-Party Integrations

Most of the fintech applications are working along with banks, payment gateways, credit bureaus, and analytics platforms through integrations. Such integrations not only increase the functionality of the fintechs but also introduce risks if not managed properly.

Fintech apps have employed strong APIs for secure communication that employ token-based authentication and rigorous access control measures to reduce the risk of exposure. A significant number of AI development services are now available to help keep an eye on the API usage trends, recognizing the suspicious activities instantly. The method guarantees that the outside services are not turned into soft entry points for the attackers.

6. Regular Security Audits and Penetration Testing

Security is definitely not a single shot to take, but rather an ongoing procedure. Fintech apps keep doing periodic vulnerability assessments, penetration testing, and code audits in order to discover possible loopholes.

Developer Per Hour and similar companies consider continuous testing as an integral part of the long-term maintenance of a fintech app. Regular audits not only enable the fintech sector to conform with legal stipulations but also to counteract the new types of cyber attacks that are coming up. Working with skilled AI developer organizations makes the automated surveillance and detection of threats even more powerful.

7. Real-Time Monitoring and Incident Response Systems

No matter how secure the systems are, they will still require monitoring in real-time. The fintech applications make use of sophisticated monitoring tools that constantly observe the users, the servers, and the transactions of the company, day and night. In case something unusual occurs, the security response systems will be activated without delay.

The application of modern AI development services is crucial as they allow real-time notifications and automated reactions to be implemented. Such systems can put a hold on the accounts, stopping the transactions that seem to be suspicious, and informing the users all at the same time—thus, the loss in money and reputation is minimized. A professional mobile app development agency USA will take care that such systems are scalable and that the technical side of compliance is assured.

The Role of Technology Partners in Fintech Security

To create a secure and compliant fintech app, it is necessary to have good ideas along with skilled technology partners. Good expertise is crucial whether it is working together with a php development company for a secure backend or hiring ai development companies for fraud detection.

Developer Per Hour is one of the companies that helps the fintech sector to bring under a single strong development strategy security, compliance, and performance. Compliance frameworks, AI-powered security tools, and scalable infrastructure are integrated so that the fintech apps can win over users’ trust for a long time.

Final Thoughts

Fintech apps are managing the situations where the regulations and security are the most stringent in every aspect of the industry. Global regulatory standards will just be met through the application of such security features like user protection, encryption, AI, and the whole process of compliance monitoring.

Right cooperation with an agency for mobile app development in the USA and using state-of-the-art AI services would be the lifeline to digital finance evolution. Secure transactions and regulatory compliance have moved from being competitive advantages to becoming the minimum requirements for the success of fintech.