Are you driving a financial institution and looking to grow your business into the digital world? If yes, then you are on the right page. As mobile app popularity grows, loan lending mobile apps are also becoming a new trend in the fintech industry. This blog will discuss loan lending app development costs and key features.

This article will guide you about the features and cost of a loan lending mobile app development, including its advanced functionalities, that will give your app a competitive edge. By the end of this write-up, we can bet you will know if investing in a money-lending mobile app development is profitable, the types of such apps, market statistics, advantages, and more. Considering these aspects, you can surely bring a successful app.

What is a Loan Lending Mobile App?

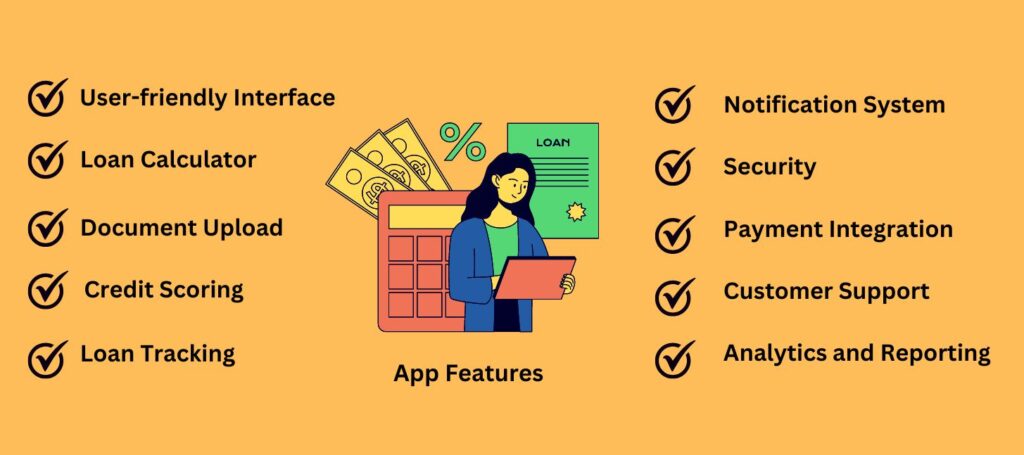

A mobile app that’s crafted to offer users ease of applying for and managing various types of loans is a loan lending mobile app. With the increasing use of smartphones and the need for on-demand apps, money-lending apps are usually adopted by money lenders and users.

Typically, such apps have various amazing features, like loan calculators, account management tools, and document uploads.

Using such apps, borrowers can apply for loans easily, track their loan status, receive notifications, and make payments directly via mobile devices. Lenders can use such apps to simplify loan processing and offer their consumers rapid and more efficient services. The loan lending mobile app development has transformed the loan industry, easing it for lenders to manage loan operations and borrowers to access funds.

How Does a Loan Lending Mobile App Work?

For Lenders

Online mobile loan apps offer lenders a digital platform that eases loan processing, allowing them to enhance their efficiency and revolutionize their operations. Such apps can diminish the resources and time needed for loan processing, permitting lenders to review and approve loans faster.

Besides, lenders can use the app to chat with borrowers, track their loan statuses, and handle their loan accounts, all from a centralized platform. Mobile lending apps hold the caliber to offer lenders valuable insights and data on borrower behavior, facilitating them to make well-informed lending decisions and enhance their risk management approaches.

For Borrowers

The instant mobile loan apps provide an accessible and convenient way for borrowers to apply for and handle loans. This saves their time and makes the money lending process hassle-free, without needing to visit the lender’s location physically.

Furthermore, on these apps, the eligibility checkers and loan calculators can assist borrowers in determining the amount and type of loan they can qualify for. Its management features assist borrowers in tracking their loan status, making payments, and getting notifications directly using their mobile devices.

Read More: Digital wallet app development guide 2023

Most Sought-After Loan Types

Student Loans

As the name reflects, these apps provide financial assistance to students for their education-relevant expenses, like textbooks, tuition fees, and living expenses. The best part of these mobile apps is that they offer flexible repayment terms and low-interest rates to ease students’ pay back their loans once they get employment.

Personal Loans

Such loan apps offer unsecured loans for varied purposes, like emergency expenses and debt consolidation. The interest rates are competitive, and approval times are speedy, making it the perfect option for people who need money fast.

Startup or Small Business Loans

These money-lending apps provide funding for small businesses or startups. The interest rates are competitive, and repayment terms are easygoing. They offer term loans, lines of credit, and equipment financing to assist businesses in attaining their financial requirements.

Mortgages or Home Loans

Such applications offer funds for purchasing homes or refining current mortgages. The loans can be adjustable or fixed-rate mortgages, and the apps offer mortgage calculators to assist people in making better decisions about their home financing.

Car Loans

If you are looking forward to buying a car, this is the application type you are looking for. These apps provide loan calculators, pre-approval for loans, and comparison tools to assist people in making well-informed decisions when purchasing a car. They let people pick the best loan option for their financial goals and budget.

These are some of the most common loan lending applications in the market for a long time. Several other applications like cash advance applications are designed to help users manage their expenses in tough times.

Also Read: How to Develop Cash Advance App, Like Dave

Why Invest in Loan Lending App Development?

Investing in money lending mobile apps can be a beneficial decision for businesses looking to extend their offering and fulfill the emerging demand for mobile-based financial services. Let’s check out the latest statistics that will prove this point.

- In 2020, the personal market size was valued at $47.79 billion and was likely to attain $719.31 billion by 2030 with a Compound Annual Growth Rate (CAGR) of 31.7%.

- In 2021, the P2P lending market size was around $82.3 billion, and by 2030, it is expected to catch up to $804.2 billion at a CAGR of about 29.1%.

- The worldwide Fintech lending market size was valued at $449.89 billion in 2020. By 2030, it’s projected to reach $4,957.16 billion at a CAGR of 27.4%.

Besides, loan lending apps can offer customized loan options to borrowers based on their financial profile and credit history. Such apps provide borrowers with quick loan approvals who need instant money. Additionally, these genuine loan apps prioritize data security and utilize advanced encryption technology to protect borrowers’ data. The competitive interest rates and the loan terms attract borrowers to request loans and meet their needs.

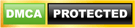

General Features of Loan Lending Mobile App

Advanced Features Of Loan Lending Mobile App

Chatbot

AI-powered chatbot offers rapid assistance and manages customer queries relevant to loan processing.

Loan Calculator

This tool assists borrowers in calculating loan eligibility, interest rates, and repayment terms.

CMS integration

Integration with content management systems enables the app to offer suitable content and updates to borrowers.

Integrated cloud storage

Secure storage of small loan app data and documents on integrated cloud storage facilitates lenders and borrowers to access them.

Bank Partner Management

This feature of a loan lending app allows lenders to supervise their banking partners and simplify loan processing.

Online Support

Easy access to online support, including phone and chat support, lets borrowers and lenders communicate.

Push notifications

Timely notifications about loan approvals, reminders, and payments are delivered directly to borrowers’ mobile devices.

Supports Multiple Languages and Currencies

It permits borrowers to access the application in their preferred currency and language, making it better accessible to a global audience.

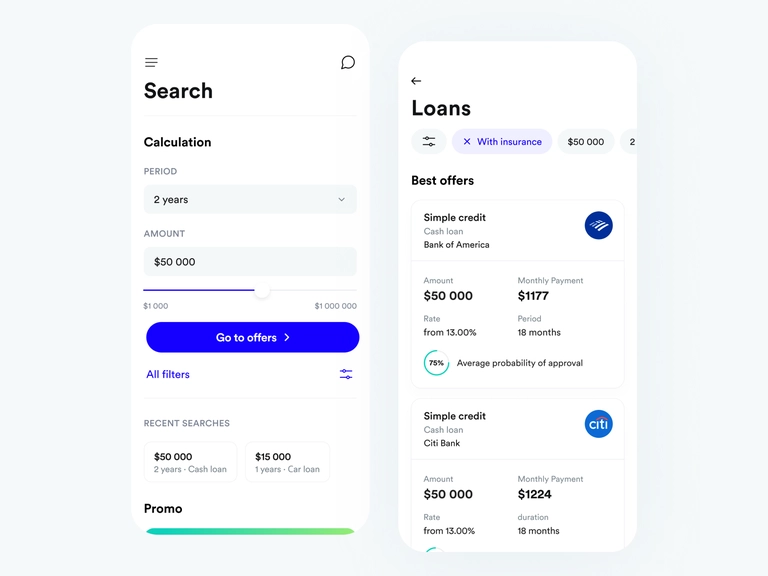

Steps to Develop a Loan Lending App?

When you hire loan lending app developers, they bring up a strategic plan. This involves several critical steps that need to be followed to ensure that the app is functional, secure, and user-friendly.

Here are the essential steps involved in developing a loan lending app:

Define App Requirements

Start by defining the goals and objectives of the lending app. Determine the app’s target audience, the types of loans to be offered, and the app’s key features and functionalities. Your development team and others must have a clear picture of the final functioning and operations of the app.

Conduct Market Research

Understanding the market is another important thing before development starts. Conduct market research to understand the competition, identify market gaps, and assess customer needs. This research will help you identify features to include in your app that can make it stand out.

Consider Security and Compliance

The kind of business you are setting up needs to stick to come to finance compliances and security standards. We ensure that the solutions deployed to you abide by the government rules and regulations.

Choose a Business Model

It’s important when you decide to enter the market, that you have a clear understanding of the

Create a Wireframe

The loan lending app developers would provide a blueprint outlining the app’s features, user interface, and user journey. This wireframe reflects the app’s functionalities and components to ensure a clear understanding of the app’s layout and design.

Develop the App Architecture

Once the wireframe is ready, the next step is developing the app’s front-end, back-end, and database. Ensure the app architecture is scalable, secure, and can handle high traffic and user data.

Develop the App’s User Interface

Develop an intuitive, user-friendly, and engaging user interface that users can easily navigate. Ensure the user interface is responsive and optimized for different devices and screen sizes.

Integrate APIs and Third-party Services

To let your users enjoy various functions and features, the dedicated loan app development team integrates APIs and third-party services to allow users to access their bank account details and complete loan applications within the app. Ensure the APIs and third-party services are secure and compatible with the app.

Testing

Check your app thoroughly to ensure it is functioning correctly and error-free. Conduct usability testing to ensure users can easily navigate the app and complete loan applications. At DPH you can hire a QA and testing team and dedicated developers to ensure the product deployed is worthy and exactly as you wanted.

Launch

Once the app has been tested and is error-free, launch the app on the desired platforms, such as iOS and Android, and make it available for download.

Maintenance

Monitor the app for bugs and security threats and update it regularly to enhance its features and functionalities. Provide customer support to ensure that users have a smooth and positive experience when using the app.

As you decide to move forward with developing a loan lending app, it requires a clear understanding of user needs, careful planning, attention to detail, and continuous monitoring and improvement to ensure that the app is functional, secure, and meets user expectations.

Visit Also: Best Cash Advance Apps 2023

Advantages Of Loan Lending Apps

For Lenders

1. Cuts operational costs

Automated loan processing on money lending apps minimizes manual efforts, reducing operational costs and boosting profits.

2. Multiple customers

Such apps are capable of serving numerous customers simultaneously, expanding the lender’s customer base and revenue.

3. Speedy KYC procedures

Speedy and efficient Know Your Customer (KYC) procedures via digital verification save users time and effort.

4. Artificial intelligence

AI-powered algorithms are used for fraud detection, risk assessment, and credit scoring, enhancing lending decisions and diminishing risk.

5. Maximum reach

Such apps can reach a wider audience and improve market penetration through a mobile app accessible to borrowers anytime and anywhere.

For Buyers

1. Simple procedure

An online lending app’s user-friendly and easy loan application process helps reduce the time and effort needed for a loan application.

2. Discreet process

A sensitive and confidential loan application process protects the borrower’s privacy and sensitive personal information.

3. Managing the applications

The money lending app is known for easily managing loan applications, making payments, and viewing loan status using a single mobile app by raising transparency and convenience.

4. Security

The easy mobile loan app protects borrowers from cyber threats and potential fraud by ensuring the security of financial and personal information following encryption and other security measures.

5. Loan options

Money lending apps offer various loan options with competitive interest and flexible terms to meet borrowers’ needs and financial situations.

6. Accountability

Ensuring transparency and accountability in loan processing and repayment terms, money lending apps develop trust between lenders and borrowers and promote responsible borrowing.

Things to Consider When you are Going to Develop Loan Lending App

Developing a loan lending app is a complex and challenging process that requires careful consideration of several factors. Some key things to consider when developing a loan lending app are:

Compliance with Regulations

Before developing a loan lending app, it is essential to research and complies with relevant regulations and laws. Depending on your location, you may need to obtain licenses, comply with consumer protection regulations, and follow data protection laws.

Integration with Payment Gateways

Your loan lending app must be integrated with payment gateways to enable seamless payment processing. This means partnering with payment service providers or building your payment gateway.

Loan Decision-making Process

The loan decision-making process should be transparent, fast, and reliable. This means incorporating AI and machine learning algorithms to analyze user data, credit scores, and financial history to make accurate lending decisions.

Customer Support

A loan lending app must have a responsive customer support team that can handle customer queries, concerns, and complaints promptly and effectively.

Scalability

Finally, your loan lending app should be scalable to accommodate growth in the user base and loan volume. This means building a robust architecture that can handle high traffic and integrating the latest technologies to enhance performance and efficiency.

By considering these factors, you can develop a loan lending app that is secure, user-friendly, and compliant with regulations.

Cost Of Developing A Loan Lending App

The loan lending app development cost may vary depending on varied factors that affect the development cost, like the app’s complexity, development time, team of developers, their location, features included, the app platform you choose to build your app on, Android or iOS or both, maintenance costs, and more.

Basic money-lending mobile app development costs about $15,000, while a complex one may cost over $50,000 or higher. For more details, you can hire a leading app development company and craft a detailed project plan with them. Consequently, you can ensure you build a trusted loan app within your desired budget and timeline.

How Can DPH Help You Build Your Feature Packed Loan Lending Mobile App?

Are you devising to develop your feature-packed loan lending mobile app but finding it confusing to start? Stop your search here; DPH’s app development team, with years of experience in varied industries, will help you with the best. A specialized team of professionals holds the caliber to build custom mobile apps meeting your business-centric requirements.

DPH, a trusted app development partner, will help you with the skills you need for your project. It performs collaboratively with our clients and creates a detailed plan for their projects, including app platforms and features. It ensures you catch up with a high-quality app that may engage more borrowers and lenders. With perfect guidance and expertise, you can develop a feature-packed money-lending app that attains your business essentials and enables you to reach a wider audience. So, partner with DHP today and take your first step towards developing a successful loan lending mobile app.

Conclusion:

Loan lending mobile app development can be a profitable investment for businesses to boost their revenue and catch up with a wider audience. Although the cost of building a mobile loan app may vary depending on varied factors, you should include them while deciding your budget and timeframe. Hire an experienced mobile app development company and ease your online mobile loan app development process to ensure a successful project.

Alternatively, you can connect with our app development consultants, find a successful way to your app development project, and take your business to a level ahead. Connect with us today!

FAQs:

Building a loan lending app can include variable costs depending on various factors like app features, complexity, and development time. A basic loan lending app may cost around $15,000 to $20,000, while a more complex app holding advanced features and integrations may surpass $50,000 or more in cost.

Yes, loan apps in India must be registered with the Reserve Bank of India (RBI) in partnership with an RBI registered Non-Banking Financial Companies (NBFC) or as NBFC. These apps must comply with RBI guidelines and regulations, including transparency in lending, interest rate caps, and fair practices.

Yes, money lending apps hold the prospects to be profitable. Still, it relies on different factors, such as the loan products offered, the app’s target market, business strategy, and interest rates. A well-managed and well-executed urgent loan app can generate a regular income stream via interest income, loan origination fees, and other charges. Yet, marketing costs, default rates, and operational expenses may impact profitability. It needs careful planning, implementation, and monitoring.