And yes, our traditional wallets with time-turned digital, and now most of us don’t even carry one. Thanks to the surge in ewallet app development needs, most of us can scan QR codes or transfer money via our phone numbers. Without much chitter-chatter, let’s look at a digital wallet and how it transforms the business.

What is eWallet App: Introduction

Technologically, a digital payment app is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It allows users to make electronic transactions easily and quickly by eliminating the need to enter payment information manually.

In Simpler Words, an e-Wallet Is like the Traditional One on Your Phone!

Examples of e-wallets include Apple Pay, Google Pay, and PayPal.

Over the years, mobile applications have entered almost every industry. Everything is available with just a click, from food delivery to medicines to health checkups. Fintech is a growing sector. We have come a long way from debit and credit cards supporting cashless transactions to online wallet apps supporting cardless transactions.

How Does Digital Wallet App Work?

The best response to the question: Scan…Pay…Done!

Not as easy as it looks. The backstory is quite complex.

- A mobile wallet app stores users’ payment information, such as credit or debit card details, in a secure, encrypted digital format on their device or in the cloud.

- When users want to purchase, they select the payment method stored in their e-wallet and authorize the transaction.

- The app then communicates with the relevant payment networks, such as banks or card networks, to complete the transaction.

- Some e-wallet apps also offer additional features, such as rewards programs, budget tracking, and the ability to store loyalty cards and receipts.

- By using a mobile wallet, users can make quick and secure purchases without having to enter their payment information manually each time.

online wallet mobile app development is in great demand, and many opportunists want to enter the market to make the best of the scope. If you are looking forward to entering the market with a new ewallet application, you must be aware of the basic regulations and complaints.

Read More: Cash Advance App Like Dave

Why Are Digital Wallets in Demand Nowadays?

Digital wallets, also known as e-wallets, are in high demand nowadays for several reasons:

Convenience:

Digital wallets offer a high level of convenience to users. With an e-wallet, users can make payments anytime, anywhere, without the need for physical cash or cards. This can save time and make the payment process more efficient.

Security:

E-wallets offer enhanced security compared to traditional payment methods. Transactions can be encrypted, and users can set up two-factor authentication to protect their accounts. Additionally, e-wallet apps can provide real-time fraud detection, helping to prevent unauthorized transactions.

Contactless Payments:

In the wake of the COVID-19 pandemic, there has been a surge in demand for contactless payment options. Digital wallets offer a contactless payment option that can reduce the risk of infection through physical contact.

Rewards and Loyalty Programs:

Many digital wallets offer rewards and loyalty programs to incentivize users to use their apps. These programs can help to increase customer engagement and retention.

Mobile-First Generation:

The younger generation is increasingly mobile-first, relying on smartphones for most of their daily tasks. Digital wallets offer a mobile-first payment option that is in line with the preferences of this generation.

Globalization:

With the rise of globalization, people are traveling more than ever before. Digital wallets offer a convenient payment option for travelers, eliminating the need to carry multiple currencies or worry about exchange rates.

Regulations and Compliances for Mobile Wallet App Development

As ewallet mobile applications deal with financial institutions and your accounts, the government must regulate the operations and functioning and abide by the law of the land.

Payment Card Industry Data Security Standard (PCI DSS):

When working on your product, our mobile wallet app developers ensure it complies with PCI DSS to ensure the secure handling of sensitive payment information.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations:

Your remote mobile wallet app developers implement KYC and AML procedures to prevent fraudulent activities and ensure compliance with financial regulations.

Data Protection and Privacy Laws:

Before you hire ewallet app developers, affirm you have all the documents related to data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in Europe, to ensure the secure handling of personal information.

Consumer Protection Laws:

eWallet app developers must comply with consumer protection laws, such as the US Electronic Fund Transfer Act (EFTA), to ensure fair and transparent business practices and protect consumer rights.

Licensing and Registration:

mWallet app developers may need to obtain licenses and register their apps with financial regulatory bodies, depending on the jurisdiction and type of services offered.

Building an e-wallet app requires compliance with various legal and regulatory requirements to ensure the security of sensitive payment information and protect consumer rights.

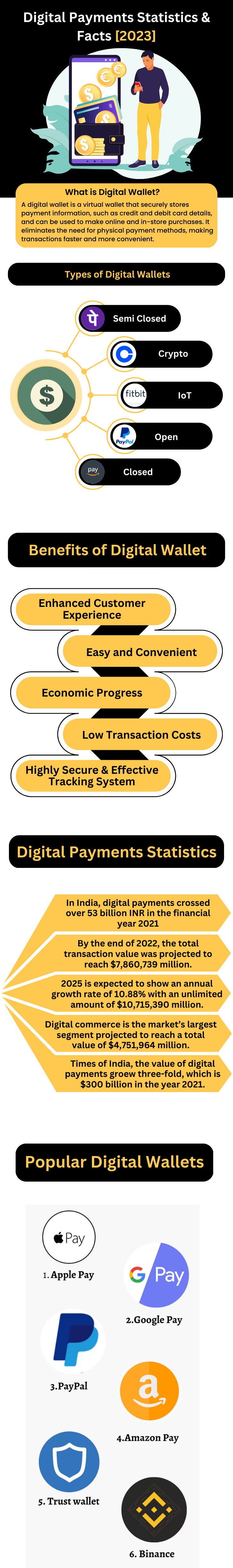

Reasons to Invest in Digital Wallet App Development – Industry Size & Statistics

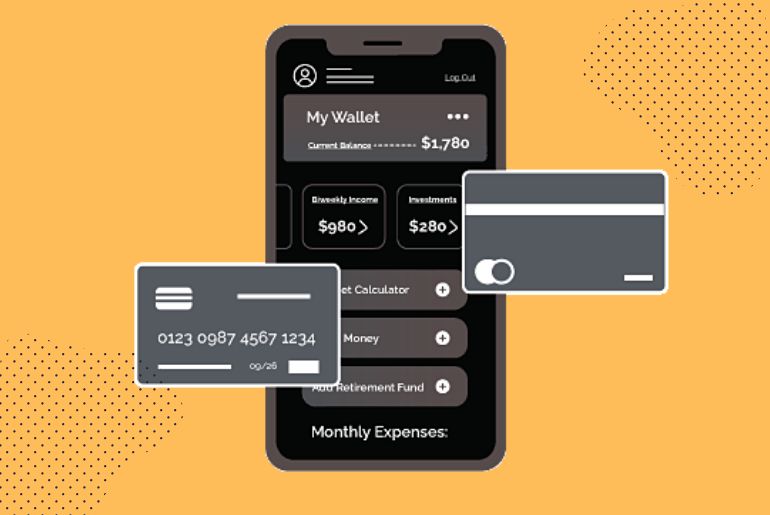

Investing in ewallet app development can be lucrative due to the growing popularity and widespread use of digital wallets. Here are some industry sizes and statistics:

The global digital wallet market size is expected to reach $19.89 trillion by 2026, growing at a CAGR of 19.5% from 2021 to 2026.

The number of ewallet users is expected to increase to 2.7 billion by 2023, up from 1.3 billion in 2019.

Mobile wallet apps are widely adopted across various age groups and regions, making them a valuable investment opportunity with a large potential customer base. They offer more comfort and security than traditional payment methods, which can drive customer engagement and retention.

The growth of mobile commerce is driving the adoption of m-wallets, with consumers using online payment solutions to make purchases and manage their finances.

Benefits of eWallet App Development?

There are many benefits to developing an e-wallet app, including:

Convenient and Accessible:

With an e-wallet app, users can make payments anytime, anywhere, without the need for physical cash or cards. This makes it a convenient and accessible payment method for users.

Fast and Efficient:

E-wallet payments are fast and efficient, reducing the time it takes to complete a transaction. This can help businesses to increase their sales and revenue, as customers are more likely to make a purchase when the payment process is quick and easy.

Improved Security:

E-wallet apps offer increased security compared to traditional payment methods. Transactions can be encrypted, and users can set up two-factor authentication to protect their accounts. Additionally, e-wallet apps can provide real-time fraud detection, helping to prevent unauthorized transactions.

Cost-Effective:

E-wallet transactions are often cheaper than traditional payment methods, such as credit cards. This can help businesses to save money on transaction fees and improve their profit margins.

Loyalty Programs:

E-wallet apps can include loyalty programs and rewards for users, which can help to increase customer engagement and retention.

Analytics and Insights:

E-wallet apps can provide businesses with valuable insights into customer behavior and spending habits. This data can be used to improve marketing strategies and drive sales.

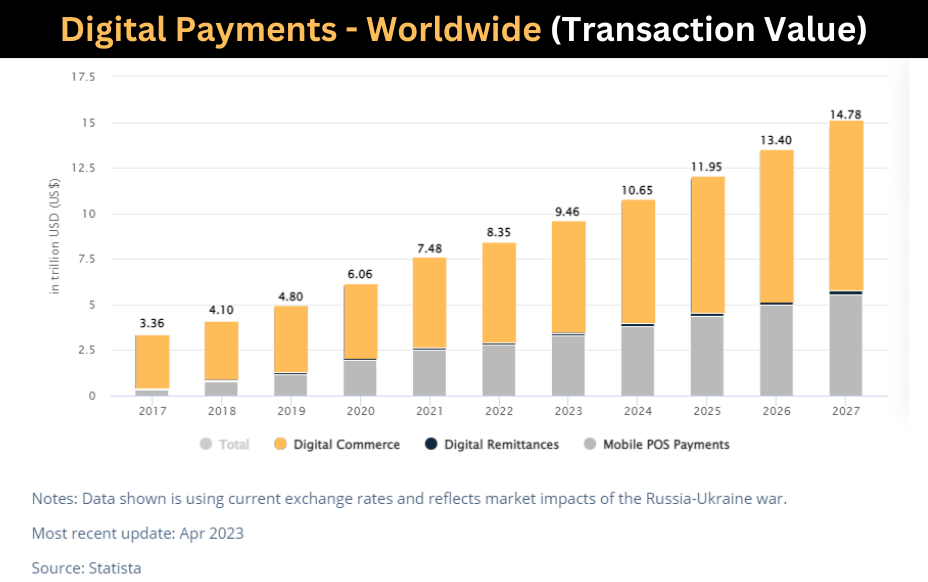

Mobile Wallet Usage Around the World:

Source: Payments Cards and Mobile

How Does an E-Wallet Aid in Boosting Businesses’ Revenue?

Digital wallets, also known as e-wallets, can aid in boosting businesses’ revenue in several ways:

Increased sales:

Digital wallets make it easier for customers to make purchases, leading to an increase in sales. E-wallets can also provide a frictionless checkout process, reducing cart abandonment rates and increasing the chances of completing a sale.

Enhanced customer loyalty:

Digital wallets can help businesses to enhance customer loyalty through the use of rewards and loyalty programs. These programs incentivize customers to make repeat purchases, leading to increased revenue for the business.

Lower transaction costs:

Digital wallets can help businesses to lower transaction costs associated with traditional payment methods such as credit card fees. This can lead to increased revenue for the business as they retain a larger portion of the transaction amount.

Improved cash flow:

Digital wallets can offer faster settlement times compared to traditional payment methods. This can improve cash flow for businesses, leading to increased revenue.

Expanded customer base:

Digital wallets can assist businesses to expand their customer base by offering a convenient payment option for customers who prefer to pay with their smartphones. This can help to attract new customers and increase revenue.

Improved data analysis:

Digital wallets can provide businesses with valuable data on customer behavior, purchase history, and preferences. This data can be used to improve marketing strategies and increase revenue by targeting customers with relevant offers and promotions.

Overall, digital wallets can aid in boosting businesses’ revenue by increasing sales, enhancing customer loyalty, lowering transaction costs, improving cash flow, expanding the customer base, and providing valuable data for marketing analysis.

Different Online Payment Transactions Methods

There are various ways customers can make online payments. Some main ways where

NFC (Near Field Communication):

NFC is commonly used for various applications, including mobile payments, digital identity verification, and wireless device pairing. With NFC, devices can communicate and exchange information with each other without the need for a physical connection or a Wi-Fi or cellular network.

Bluetooth and iBeacon:

Bluetooth and iBeacon are technologies that can be used for proximity-based mobile payments. With iBeacon, a retailer can set up a network of small, low-cost Bluetooth devices (iBeacons) in their store.

Cryptocurrencies:

Cryptocurrencies are digital or virtual currencies that use cryptography to secure transactions and control the creation of new units. Bitcoin is the most well-known example.

Payment Apps:

E-wallets are digital versions of traditional wallets that store money, allowing users to purchase without physically handling cash or cards. Examples include PayPal, Skrill, and Venmo.

Electronic Fund Transfer (EFT):

EFT is the electronic transfer of money from one bank account to another, either within a financial institution or across multiple institutions.

Online Banking Transfer:

This involves transferring money from one bank account to another through a bank’s website or mobile app.

Contactless Payment:

Contactless payment is a payment method for purchases by holding a debit or credit card near a card reader without physically inserting or swiping the card.

The growing popularity and adoption of digital wallets and the increasing use of mobile devices for commerce make digital wallet app development a promising investment opportunity.

Checkout More: Best Cash Advance Apps

Industries That Boosting Uses of eWallet Apps

- ECommerce Industry

- Food and Grocery Delivery

- Cab and Taxi Booking

- Online Bill Payment

- Ticket and Booking

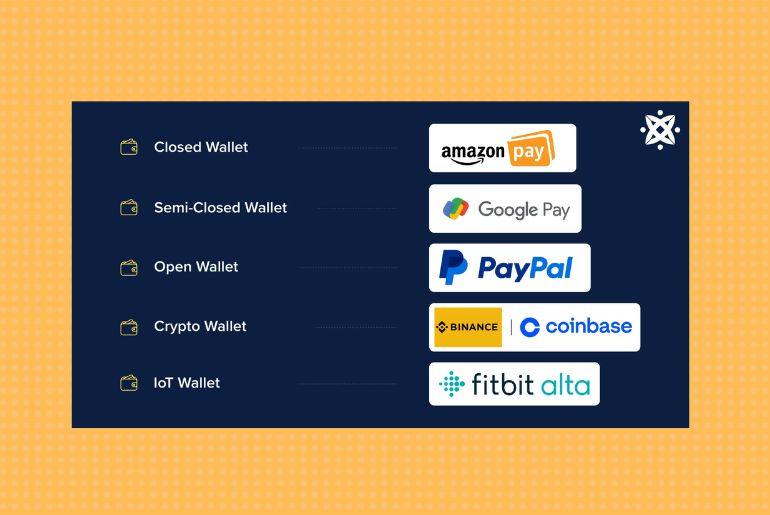

Types of e-Wallet Apps You Can Develop

Open eWallets

Open wallets refer to digital wallets that allow users to store and manage their cryptocurrencies and digital assets in a decentralized manner. It does not rely on a central authority or intermediaries for transactions but instead uses blockchain technology for secure and transparent transactions.

Open wallets typically give users full control over their private keys and seed phrases, which are used to access and manage their digital assets. Some popular examples of open wallets include MyEtherWallet, MetaMask, and Ledger Live.

These wallets offer easy setup, storing multiple cryptocurrencies securely and interacting with decentralized applications (dApps). They are typically more secure than centralized wallets, as users have full control over their assets and private information.

Semi-Closed eWallets

Semi-closed wallets refer to e-wallets offering features from open and closed wallets. They balance security and convenience, allowing users to have some control over their digital assets while still providing a more user-friendly experience. These wallets enable users to store their private keys on their devices. At the same time, the central authority manages the wallet’s and digital assets’ security.

Examples of semi-closed wallets include exchanges such as Binance and Kraken, which allow users to store and manage their digital assets through the exchange’s platform. They also offer the option to store private keys on their devices securely.

Closed eWallets

Closed wallets refer to digital wallets that a central authority or a company manages. Unlike open wallets, closed wallets do not allow users full control over their private keys and seed phrases. The company or central authority retains control over the user’s digital assets.

Closed wallets typically offer a more user-friendly experience, as the company manages the technical aspects of the wallet, such as security and storage. Some famous examples of closed wallets include Coinbase, Square Cash, and PayPal.

Users must trust the central authority or company to secure their digital assets correctly and may need more access and management options. Additionally, closed wallets may be subject to restrictions or limitations imposed by the company, such as limitations on which cryptocurrencies can be stored or transaction restrictions.

Crypto Wallet App

Bitcoin, Ethereum, and other cryptocurrencies may be stored and transferred using apps in this category. Apps in this category include Binance, Brace, Coinbase, etc.

IoT Wallet Apps

These programs allow payments for household items like appliances and clothing. Fitbit Pay is an illustration of an app in this category.

Top eWallet Mobile Apps Around The World

Apple Pay, Google Pay, Samsung Pay, PayPal, PayTM

PhonePe, Venmo, Zelle, Square Cash, Alipay, WeChat Pay, Stripe

List of Some Top 6 Digital Wallet Apps 2024

PayPal:

PayPal is one of the most widely used digital wallet apps. It allows users to send and receive money, make purchases online, and link their bank accounts and credit cards.

Google Pay:

Google Pay allows users to make payments in stores, and online, and send money to friends and family. It also offers rewards for using the app.

Apple Pay:

Apple Pay is a mobile payment service that allows users to make payments in stores, online, and in apps using their Apple devices.

Venmo:

Venmo is a digital wallet app that allows users to send and receive money from friends and family. It also offers a social media-like feed that allows users to see their friends’ transactions.

Alipay:

Alipay is a popular digital wallet app in China that allows users to make payments, book travel, and even pay bills. It also offers features like mobile top-ups and investment opportunities.

Samsung Pay:

Samsung Pay is a mobile payment service that allows users to make payments in stores, online, and in-app using their Samsung devices. It also offers loyalty programs and rewards for using the app.

It’s worth noting that the popularity of these digital wallet apps can vary depending on the region and country.

Industries That Boosting Uses of eWallet Apps

The use of e-wallet apps is becoming increasingly popular across various industries, including:

Retail:

Retailers are integrating e-wallet apps into their payment systems to provide a seamless checkout experience for customers. This is particularly popular in the e-commerce sector, where customers can make purchases online using their preferred payment method.

Food and Beverage:

The food and beverage industry is also adopting e-wallet apps to make it easier for customers to pay for their orders. Many restaurants and cafes now accept mobile payments through e-wallet apps, allowing customers to pay for their meals without cash or cards.

Transportation:

The transportation industry is also adopting e-wallet apps to make it easier for customers to pay for fares. This is particularly popular in the ride-sharing sector, where customers can pay for their rides through the app.

Entertainment:

The entertainment industry is adopting e-wallet apps to make purchasing tickets for movies, concerts, and other events easier for customers. Many ticketing platforms now accept mobile payments through e-wallet apps, allowing customers to purchase tickets on the go.

Travel and Hospitality:

The travel and hospitality industry is also adopting e-wallet apps to provide a more convenient payment method for customers. This includes hotels, airlines, and travel agencies, which are integrating e-wallet apps into their payment systems to provide a seamless booking and payment experience for customers.

Healthcare:

The healthcare industry is also adopting e-wallet apps to facilitate payment for medical services. This includes hospitals, clinics, and pharmacies, which are integrating e-wallet apps into their payment systems to provide a more convenient and secure payment method for patients.

Overall, the use of e-wallet apps is becoming increasingly popular across various industries as businesses strive to provide a more convenient and secure payment method for their customers.

Key Features to Consider in eWallet App Development in 2024

As we talk about any digital wallet application, their features play the lead here. When hiring developers for e-wallet app development, ensure they integrate features that help your product stand out from the rest.

Customer Panel – eWallet App Development

Multi-Currency Support:

To reach a wider audience, affirm your application can store multiple currencies in the digital wallet and easily switch between them.

Contactless Payments:

Your application must let users make contactless payments using NFC technology. This would give users ease and save them time.

Bill Payments:

One primary feature of a mobile wallet app is to let users pay bills and manage recurring payments.

Transfer Money:

The ability to transfer money to other e-wallet users or bank accounts.

Card Management:

Let your digital wallet App add, manage, and remove payment cards from the m wallet.

Budgeting and Money Management Tools:

Features that help users track their spending, set budgets, and monitor their financial goals.

Rewards and Offers:

Let your wallet app gives users exclusive offers and earn rewards for using the digital wallet App.

Transaction History:

Users feel it is easy to have a complete record of all transactions made using the M wallet Application, including date, time, amount, and merchant details.

Secure Login:

To build credibility, your application must have advanced security features such as biometric authentication and secure password management. This keeps users’ financial information safe.

Merchant Panel – Mobile Wallet App Development

Acceptance of Mobile Payments:

Merchants can accept payments made through a digital wallet App.

Payment Processing:

Seamless payment processing and settlement of transactions.

Customer Data Management:

Ability to collect, store, and analyze customer data to understand buying patterns and preferences better.

Reporting and Analytics:

Access real-time reporting and analytics to track sales, transactions, and customer behavior.

Secure Transactions:

Advanced security features ensure the safe processing of transactions and protect sensitive customer information.

Integration with Point of Sale (POS) System:

Ability to integrate the ewallet with the merchant’s existing POS system for a seamless checkout experience.

Customer Engagement:

Tools to engage customers and increase loyalty include rewards and loyalty programs.

Multi-Channel Support:

Ability to accept payments through multiple in-store, online, and mobile channels.

Invoicing and Receipt Management:

The ability to create and manage invoices and receipts electronically.

Customer Support:

Access to customer support and technical assistance to resolve any issues.

Super Admin – eWallet App Development

User Management:

Checking and verifying your application’s users and service providers is essential. Our developers integrate the ability to work and monitor user accounts, including adding, editing, and deleting users.

Transaction Monitoring:

Real-time monitoring and tracking of all transactions made through the digital wallet would help you verify the authenticity of the transactions and in case any issue arises it can be resolved in less time.

Reporting and Analytics:

Access to detailed reports and analytics to track system usage, transaction patterns, and user behavior helps business owners understand the functioning and working of the application and the areas they want to focus on.

Dispute Resolution:

The mobile wallet app developers integrate tools and processes for resolving disputes and customer complaints.

Compliance Management:

Sticking to rules and regulations is a significant challenge when discussing a business as critical as finance. We ensure your digital wallet complies with financial regulations and laws.

Technical Maintenance:

The admin is responsible for maintaining and upgrading the digital wallet’s technical infrastructure to ensure its performance and security.

Customer Support:

The admin needs to manage customer support, including responding to inquiries, resolving issues, and providing technical assistance.

Marketing and Promotion:

The admin panel comes with tools and resources for promoting the digital wallet and attracting new users.

User Feedback:

The ability to collect and analyze user feedback to continuously improve the online wallet and its features.

TechStack Required to Develop Digital eWallet App

Server-side Development:

A robust and scalable server infrastructure, typically built using languages such as Node.js, Ruby on Rails, or Java and hosted on cloud platforms such as Amazon Web Services (AWS) or Google Cloud Platform (GCP).

Database Management:

A database management system such as MySQL, MongoDB, or Cassandra stores and manage user information, transactions, and other data.

Payment Gateway Integration:

Integration with popular payment gateways like Stripe or PayPal to securely process transactions.

Mobile App Development:

Cross-platform mobile app development using technologies such as React Native or Flutter to ensure compatibility with both iOS and Android devices.

Security Tools:

Advanced security features such as encryption, biometric authentication, and secure socket layer (SSL) certificates protect sensitive user information and transactions.

User Interface (UI) and User Experience (UX) Design:

A user-friendly and intuitive design that makes it easy for users to navigate the mobile wallet and complete transactions.

Analytics and Monitoring:

Tools such as Google Analytics or Mixpanel track user behavior and usage patterns and identify improvement areas.

Continuous Integration and Deployment (CI/CD) Pipelines:

Automated tools and processes to ensure efficient and streamlined development, testing, and deployment of updates and new features.

Project Management Tools:

Tools such as JIRA or Trello to manage the development process and keep all stakeholders informed of progress.

Team Structure Required for Developing a Mobile Wallet App

- App developers

- Front-end developers

- Back-end developers

- UX/UI designers

- Quality Analyst

- Business Analyst

- Project Manager

Monetization Opportunities Offered by Ewallet Apps

E-wallet apps offer several monetization opportunities for app owners, including:

Transaction fees:

E-wallet apps can charge a small percentage fee on each transaction made through the app. This fee can range from 1% to 3% of the transaction amount, depending on the app’s policies and the industry it serves.

Subscription fees:

E-wallet apps can offer premium features and charge a subscription fee for users to access these features. For example, an app could offer enhanced security features or faster transaction processing speeds for a monthly or yearly fee.

Interchange fees:

E-wallet apps can earn revenue by charging merchants an interchange fee for each transaction made through the app. This fee is typically a percentage of the transaction amount and is paid by the merchant to the app owner.

In-app advertising:

E-wallet apps can offer in-app advertising to generate revenue. For example, an app could display ads from relevant merchants or third-party advertisers within the app.

Partner commissions:

E-wallet apps can earn revenue by partnering with other businesses and earning commissions on transactions made through the app. For example, an app could partner with a retailer and earn a commission on sales made through the app.

Data monetization:

E-wallet apps can also monetize user data by selling it to third-party advertisers or using it to offer personalized offers and promotions to users. However, it’s essential to ensure that user data is collected and used in compliance with applicable laws and regulations.

eWallet App Development – Key Challenges

When developing e-wallet applications, developers face several challenges. As you hire an e-wallet app development team for your project, they know the issues and can find a solution quickly.

Security and Privacy:

The top priority is ensuring the secure storage and transfer of sensitive financial information and personal data.

Payment Integration:

Integrating various payment methods and ensuring seamless transaction processing.

User Experience:

One challenge to making a profitable digital transaction application is user experience. Our dedicated developers build a user-friendly interface and provide easy navigation for users.

Regulatory Compliance:

Any financial application needs a legal and regulatory backup. Ensure the app complies with financial regulations and laws, such as anti-money laundering and data protection laws.

Scalability:

One important factor of online transactions is quick and instant. Building a system that can handle many transactions and users while maintaining speed and reliability.

Cross-Platform Compatibility:

Deciding on the right platform to launch your app and reach the target audience could be another challenge. Ensuring the app works seamlessly on different platforms and devices.

Technical Complexity:

Dealing with the technical complexities of building a digital wallet app, such as dealing with encryption, data storage, and real-time updates. Most of us may know the cyber threats that come with such applications but dealing with these isn’t easy.

Maintenance and Upgrades:

Your ewallet application would need regular maintenance and upgrades for smooth execution. Also, with time and increasing demands, you must add new features.

This becomes challenging as the application deals with fragile data and extensive maintenance and upgrade risks.

Factors That Influence e-Wallet App Development Cost

Several factors can influence the cost of developing an e-wallet app, including:

Features and Functionality:

The more features and functionalities you want to include in your e-wallet app, the higher the development cost will be. Features like in-app payments, transaction history, and rewards programs will all increase the complexity of the app.

Platform:

The platform you choose to develop your app on can also impact the development cost. Developing an app for both iOS and Android will cost more than just one platform.

Design:

The complexity of the design and user interface (UI) can also impact the cost of app development. A simple design with basic UI elements will cost less than a complex design with custom graphics, animations, and interactive elements.

Security:

Security is critical when it comes to e-wallet apps, and implementing strong security features can add to the development cost. This includes measures such as encryption, two-factor authentication, and fraud detection.

Integration with Payment Gateways:

Integration with payment gateways like PayPal, Stripe, or Square can also affect the development cost. Each gateway has its own set of requirements, and integrating them into your app can add to the development time and cost.

Testing and Maintenance:

It is important to test the app and ensure it works smoothly. Maintaining the app and providing support can also increase the overall development cost.

Read More: Loan Lending App Development Cost & Features

How to Create an E-Wallet Mobile App: A Step-by-Step Guide

Creating an e-wallet mobile app can be a complex process, but here is a general step-by-step guide:

Define your business goals and requirements:

Start by defining the goals and requirements for your e-wallet app. What features do you want to include? What platform will you develop the app for?

Choose a development team:

Choose a development team that has experience in developing e-wallet apps. Consider factors such as their portfolio, team size, and experience working on similar projects.

Conduct market research:

Conduct market research to identify your target audience, their needs, and their pain points. This can help you to create an app that meets the needs of your target audience.

Plan the app design:

Plan the design of your e-wallet app, including the user interface (UI), user experience (UX), and app flow. Consider using wireframes and mockups to help you visualize the design.

Develop the app:

Develop the app using a programming language such as Java, Swift, or Kotlin. Implement features such as account creation, authentication, in-app payments, transaction history, and security features.

Test the app:

Test the app to identify and fix any bugs or issues. This includes functional testing, usability testing, and security testing.

Launch the app:

Once the app is tested and approved, launch it on the chosen platform(s). Consider factors such as app store optimization (ASO), marketing strategies, and customer support.

Maintain and update the app:

Maintain and update the app to ensure it continues to meet the needs of your users. This includes fixing bugs, adding new features, and improving the user experience.

Creating an e-wallet mobile app requires a lot of planning, development, and testing, but it can provide significant benefits for both businesses and users. Consider working with a professional development team to ensure the app meets your goals and requirements.

How Much Does it Cost to Develop an e-Wallet App?

The cost of developing an e-wallet app can vary depending on several factors such as features, functionality, complexity, platform, and development team rates. Here are some cost estimates for developing a digital-wallet app:

Basic e-wallet app:

A simple e-wallet app with basic features such as account creation, authentication, in-app payments, transaction history, and security features can cost between $10,000 to $30,000.

Mid-range ewallet app:

An e-wallet app with additional features such as loyalty programs, QR code payments, social media integration, and multi-currency support can cost between $30,000 to $50,000.

Advanced e-wallet app:

A complex e-wallet app with advanced features such as NFC payments, peer-to-peer transactions, real-time fraud detection, and blockchain integration can cost upwards of $50,000 or more.

It is important to note that these cost estimates are just general guidelines, and the actual cost of developing an e-wallet app can vary depending on the specific requirements and complexity of the project. Additionally, ongoing maintenance and updates can add to the app’s overall cost. It is recommended to consult with a professional development team to get an accurate cost estimate based on your specific requirements.

How can DPH Help to Develop Your Own Mobile Wallet App?

As you connect with DPH for ewallet app development services, there are a few things that we take care of. We understand your business is unique, and the application you want to design must stand out above all: You can hire eWallet App Developers from DPH at affordable prices.

Sign a Confidentiality Agreement:

To maintain the uniqueness of your business and our contract, we sign a non-disclosure agreement, where we share the partnership clause by both parties.

Take Time and Money, Seriously:

Our wallet app developers get things done despite stringent deadlines. We value your time and money and affirm that the time to market isn’t much for your product.

Try and Buy:

Before you hire dedicated software developers from DPH, you can use our services for a week and assess our team’s working pattern before you make the final call.

Keep to Your Time Zone:

The development team you hire will work with you at your convenience and time zone. We offer flexible solutions to make sure things fall your way.

Global Experience:

Since we have worked with international clients from various parts of the world, you would be connecting with a team with global exposure and market understanding.

After-Deployment Support:

Hire developers to assist you in updating and maintaining your product once it has been released.

Engagement Models:

Staff augmentation solutions are available as required for your business. We have various models as

- Time and Material Model

- On-demand Development Model

- Fixed Scope, Time, and Cost Model

- On-site hiring model

Hiring Models: As you connect with our team, you can hire developers in any of the ways that fit your budget and business requirements like:

- Hourly-basis

- Full-time basis

- Part-time basis

Conclusion:

As we talk about mobile wallet app development, the market is huge, and we have moved to times when cashless is the new normal. If you are looking forward to developing a solution that can help you survive the market with a unique and exciting solution, we are just a click away! We are a top ewallet app development company that offers custom digital wallet app development services.

FAQs about Digital Wallet App:

Creating an e-wallet mobile app involves several steps, including market research, choosing the right technology, designing the user interface, developing the app, testing, and launching.

The cost of developing an e-wallet app can vary depending on several factors like complexity, features, the technology used, and the development team’s location. On average, it can range from $10,000 to $50,000 or more for a basic app and $50,000 to $100,000 or more for a complex app.

A digital wallet application can benefit your business by providing customers a seamless and secure payment experience, improving customer loyalty, increasing sales and revenue, reducing cash handling costs, and offering new monetization opportunities.

The time it takes to create an e-wallet mobile app can vary depending on factors like complexity, features, technology, and the development team’s size and experience. On average, it can take 4 to 9 months or more to develop a high-quality e-wallet app, from planning to launch. It’s crucial to consult with a professional app development team to get an accurate estimate of the development timeline.